Total Loss Thresholds

Important Information:

Each state has its own governing regulations and rules. Check with your insurance company to see how this would be handled if you have a damaged vehicle in these states. Note: Most insurers who are free to make the determination that a car is a total loss use the 70% rule. So, in the states where they defer to the insurance company, you should expect the limit to be approximately 70%, but this is not guaranteed and your insurance carrier can provide you with the correct information. In states where thresholds for a salvage title are specified, insurance companies will use the mandated limit in that state.

Clean Title / Clear Title / Good Title

A clean title, also known as a clear title, or good title, designates no salvage title has ever been issued for a vehicle in any state. If there is damage to a vehicle and the amount of damage is under a specific percentage, some states issue a clean title to insurance companies. Contact your insurance company to inquire if clean titles in their name are accepted.

*Contact your local Department of Motor Vehicles for specific rules and regulations.

Salvage Title

A vehicle is assigned a salvage title when it has been affirmed a total loss from vandalism, fire, theft, collision, or flood. The salvaged vehicle will not be registered or driven legally until it has a reconstructed titled issued.

*Contact your local Department of Motor Vehicles for specific rules and regulations.

Each State Total Loss Thresholds

|

State |

% Total Loss Threshold |

Comments/Source |

|

Alabama |

75% |

|

|

Alaska |

Insurer Determines |

Title affixed with junked code (J) following total loss determination. |

|

Arizona |

Insurer Determines |

|

|

Arkansas |

70% |

|

|

California |

Insurer Determines |

|

|

Colorado |

100% |

|

|

Connecticut |

Insurer Determines |

|

|

Delaware |

Insurer Determines |

|

|

Florida |

80% |

|

|

Georgia |

Insurer Determines |

|

|

Hawaii |

Insurer Determines |

|

|

Idaho |

Insurer Determines |

|

|

Illinois |

Insurer Determines |

|

|

Indiana |

70% |

|

|

Iowa |

50% |

|

|

Kansas |

75% |

|

|

Kentucky |

75% |

|

|

Louisiana |

75% |

|

|

Maine |

Insurer Determines |

|

|

Maryland |

75% |

|

|

Massachusetts |

Insurer Determines |

|

|

Michigan |

75% |

|

|

Minnesota |

70% |

|

|

Mississippi |

Insurer Determines |

|

|

Missouri |

80% |

|

|

Montana |

Insurer Determines |

|

|

Nebraska |

75% |

|

|

Nevada |

65% |

|

|

New Hampshire |

75% |

|

|

New Jersey |

Insurer Determines |

|

|

New Mexico |

Insurer Determines |

|

|

New York |

75% |

|

|

North Carolina |

75% |

|

|

North Dakota |

75% |

|

|

Ohio |

Insurer Determines |

|

|

Oklahoma |

60% |

|

|

Oregon |

80% |

|

|

Pennsylvania |

Insurer Determines |

|

|

Rhode Island |

Insurer Determines |

|

|

South Carolina |

75% |

|

|

South Dakota |

Insurer Determines |

|

|

Tennessee |

75% |

|

|

Texas |

100% |

|

|

Utah |

Insurer Determines |

|

|

Vermont |

Insurer Determines |

|

|

Virginia |

75% |

|

|

Washington |

Insurer Determines |

|

|

West Virginia |

75% |

|

|

Wisconsin |

70% |

|

|

Wyoming |

75% |

As of February 2/28/2019, Texas and Colorado are the only states that specify the limit at 100%.

*Contact your local Department of Motor Vehicles for current rules and regulations.

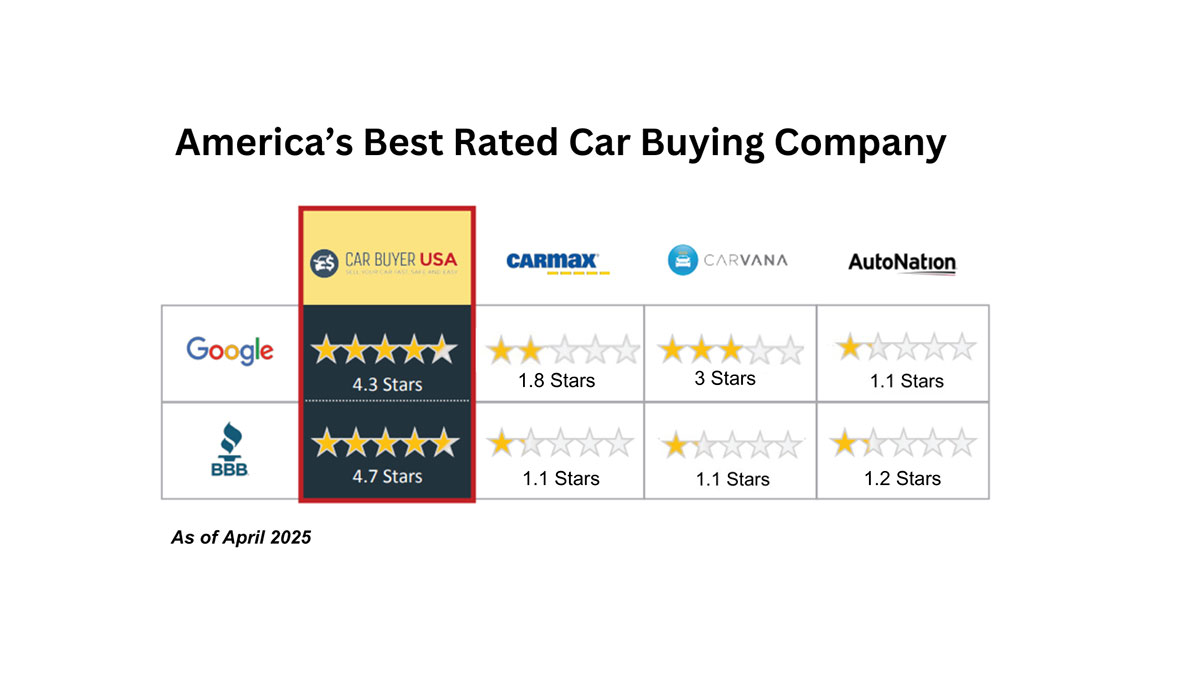

#1 Car Buying Company Ranked By Sellers

How It Works

We pay cash for cars, trucks, & SUVs, in any condition, anywhere in the Continental USA.