Yes! There Is A Way To Keep Your Equity

So, the repo notices are stacking up, your phone keeps buzzing with lender calls, and suddenly “Can I sell my car before it gets repossessed?” feels like a life-or-death question. Good news: yes, you can. And if you play it smart, you can walk away with cash in your pocket instead of watching your car get hauled off and your wallet left empty.

Waiting Is a Terrible Idea

Let’s be real: if you let the repo process start, you’re handing over control, and money, to the lender. Once your car is taken, it usually goes to auction for pennies compared to what you could get in the open market. Then, on top of losing your ride, you might still owe the difference between the loan and auction price, plus extra fees. Waiting is basically saying, “Please take my car and screw my finances.” Don’t do that.

Selling Before Repossession: How to Actually Make It Work

Yes, it’s legal, yes, it’s possible, and yes, timing is everything. Here’s the no-nonsense approach:

- Get your payoff number – Call your lender and ask how much it will take to fully pay off the loan. This sets the minimum your car needs to sell for.

- Act fast – Don’t sit around hoping the repo truck doesn’t show up. The earlier you move, the more options and leverage you have.

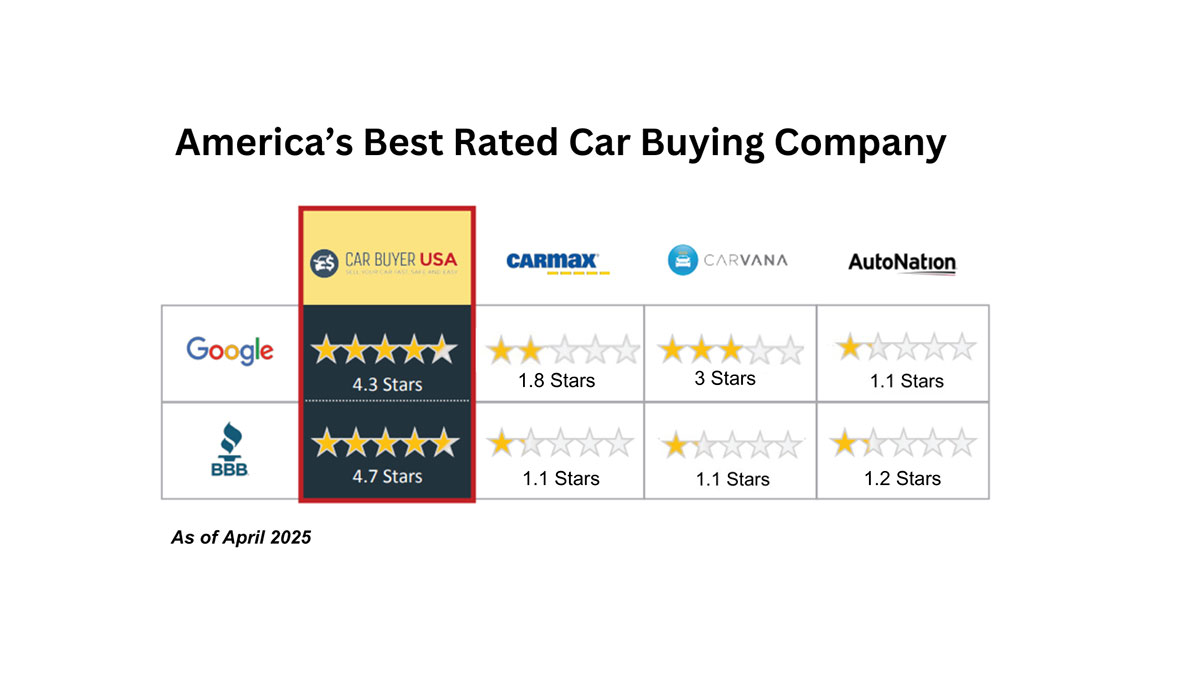

- Pick the right buyer – Sure, private-party buyers can sometimes pay more, but they’re slow, flaky, and exhausting. Trade-ins are fast, but usually lowball. CarBuyerUSA? We combine speed and fairness, with nationwide market pricing plus an inspection-backed offer, often closing in 24–48 hours.

- Handle the paperwork properly – We coordinate the payoff with your lender and ensure the title is transferred correctly so you get any leftover balance.

Why Sellers Facing Repos Love CarBuyerUSA

Here’s the truth: time is critical. CarBuyerUSA helps you sell your car before repo chaos hits, giving you a real, nationwide-market offer that beats local trade-ins and saves you from the auction nightmare. We inspect the vehicle, confirm condition, and handle all payment logistics. Your loan is paid in full and you get peace of mind immediately.

Recent sellers avoided disaster by using CarBuyerUSA: a Mazda CX-5 2021, Chevy Colorado 2020, and Toyota Sienna 2019 all sold quickly, allowing their owners to pay off loans and skip the repossession drama. Take Control Before It’s Too Late

Repossession doesn’t have to be a horror story. You still have options, but only if you act quickly. Selling to the right buyer gives you leverage, ensures fair payment, and protects your credit.

Bottom line (and yes, we mean it this time): selling before the repo truck arrives is smart. CarBuyerUSA.com makes it easy: fast, fair offers, nationwide pricing, and immediate cash. Take control, pay off that loan, and walk away with what’s actually yours. Because losing your car is stressful enough, so don’t lose money on top of it.