A Clear, Professional Guide for Today’s Sellers

Selling a leased car is not only possible, it has become a smart financial move for many drivers. With market values remaining strong in several segments, thousands of consumers are discovering that they can exit a lease early, protect themselves from unexpected charges, or even unlock equity they didn’t know they had. The process is straightforward when you understand the steps and work with a licensed buyer experienced in handling lease payoffs.

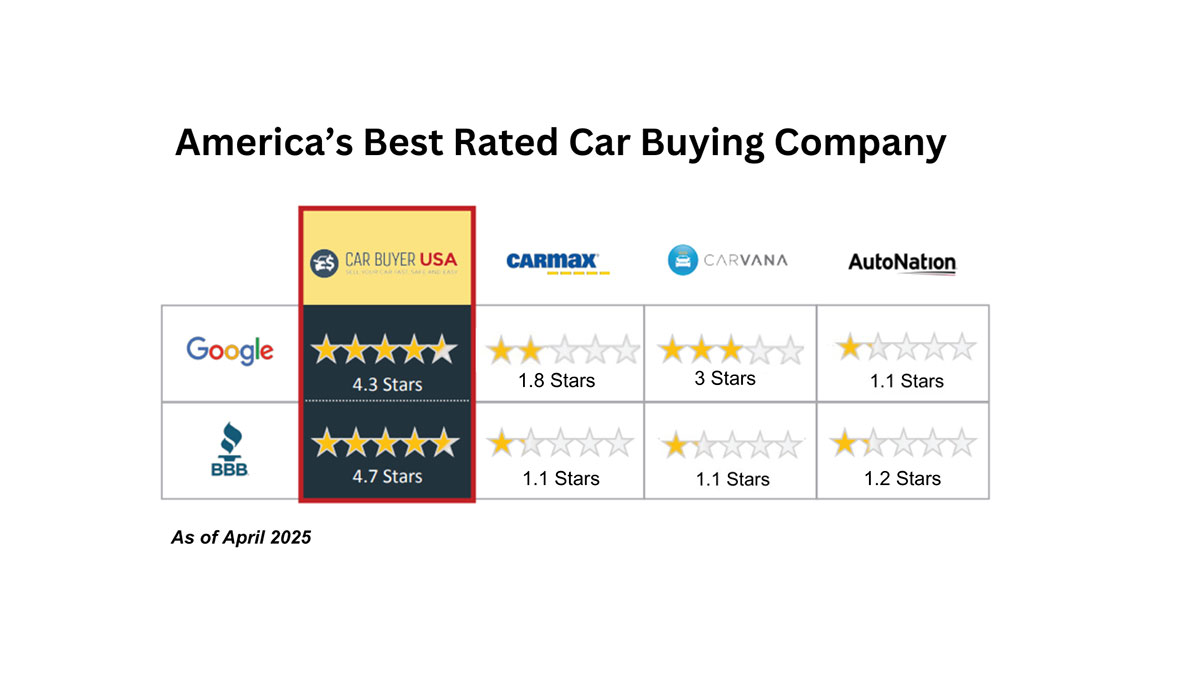

Below is a comprehensive and updated guide to help you evaluate your options and understand how CarBuyerUSA provides one of the easiest and most transparent ways to sell a leased vehicle nationwide.

1. Confirm Lease Payoff and Third-Party Permissions

Every lease begins with a residual value, the projected worth of the vehicle at the end of the term. To sell your leased car, you need the exact payoff amount from your leasing company. This may include remaining payments, residual value, and administrative fees. Because payoff figures adjust daily, obtaining a current payoff is essential.

Just as important are third-party sale permissions. Lease lenders have updated their policies frequently in recent years, and many consumers are unaware of the changes. Some lease companies allow unrestricted third-party buyouts, while others impose limitations or require special procedures. You will need to verify and receive permission directly with the leasing company so your sale is fully compliant from the start.

2. Evaluate Market Value and Determine Your Lease Equity

Once you have your payoff number, the next step is understanding your vehicle’s true market value. If the market value is higher than the payoff amount, you have positive equity, and that equity belongs to you, not the leasing company. This is one of the biggest reasons people choose to sell a leased car instead of simply turning it in.

CarBuyerUSA provides fast, data-driven valuations using nationwide live-market information. This lets you see immediately whether selling the vehicle creates a financial advantage. If equity exists, we pay it directly to you after payoff completion.

3. Understanding Documentation and Compliance

Selling a leased vehicle involves coordination between the seller, the buyer, and the leasing company.

Required documents typically include:

- A current payoff statement

- Title or electronic title release instructions

- Odometer disclosure

- Lease-end or early termination forms (varies by lender)

CarBuyerUSA will verify the lease pay-off amount, once you have given permission to the leasing company. We will also verify all documentation, and ensure every step aligns with state and lender regulations. This reduces the risk of delays, rejected payoffs, or unexpected penalties.

4. How CarBuyerUSA Makes the Process Faster and Simpler

CarBuyerUSA specializes in purchasing leased vehicles nationwide and offers a streamlined process designed around speed, accuracy, and compliance. Here is what sets the company apart:

- Nationwide service without physical facilities — lower overhead means better offers for sellers.

- Fast valuations — most customers receive a value within minutes.

- Experienced lease payoff processing — CarBuyerUSA handles lender coordination, payoff, and title release.

- Flexible logistics — depending on your location, pickup or drop-off options are available.

- Prompt payment — typically within 24 hours after inspection and payoff confirmation.

Because CarBuyerUSA deals with lease vehicles daily, our team is familiar with many major lender’s policies, required documents, and the most efficient way to complete a third-party buyout. This level of specialization eliminates the guesswork for consumers and protects them from errors that can delay or derail a sale.

If you’re considering selling your leased car, CarBuyerUSA offers one of the most efficient, secure, and lender-compliant processes available today.