Selling a truck while you still owe money on it might feel tricky, but it’s completely possible. Many owners face this situation when life changes or when they need a vehicle upgrade. The key is understanding how to handle loan payoffs, title transfers, and equity before moving forward.

✅ Why it’s possible — and legal

If your truck is financed, the lender technically holds the title until the loan is fully paid. That means you don’t yet fully “own” the truck and cannot legally transfer a clear title to a buyer until the lien is released. The good news is you can still sell the truck, as long as the loan is paid off. Many lenders and resale buyers are familiar with this process and can coordinate to make it smooth.

🔍 Step 1: Contact your lender and get a payoff amount

The first step is to call your lender and request the exact payoff amount — the total required to pay off your loan and release the lien. Keep in mind that interest accrues daily, so the payoff figure is usually only valid for a short period, often 7–10 days.

You’ll need to provide:

- Your loan account number

- The truck’s VIN

- Your name as listed on the loan/title

This information allows the lender to prepare the necessary title and lien release documents once the payment is made.

🔎 Step 2: Determine your equity — how much you’ll actually get

Next, compare the payoff amount to your truck’s market value:

- Positive equity: If the truck is worth more than you owe, you’ll pay off the loan and receive the difference as cash.

- Negative equity: If you owe more than the truck is worth, you’ll need to cover the difference out of pocket. This is the tricky part, but the sale is still possible.

Example payoff scenarios:

Truck Market Value |

Loan Payoff |

Net Cash (Positive Equity) / Amount You Owe (Negative

Equity) |

|---|---|---|

$22,000 |

$18,000 |

$4,000 cash in hand |

$18,500 |

$18,000 |

$500 cash in hand |

$16,000 |

$18,000 |

$2,000 you would pay to clear loan |

$12,000 |

$15,000 |

$3,000 you would pay to clear loan |

This table shows how the payoff math works in real life and helps you plan before selling.

🚗 Step 3: Use a buyer that handles financed vehicles

Companies that specialize in buying vehicles, even those with outstanding loans, can streamline the process. They coordinate with your lender to get the payoff amount, pay off the loan, and transfer the title. After the lien is cleared, you receive any remaining equity directly. This approach removes the stress of coordinating between private buyers, lenders, and paperwork, making the sale faster and easier.

📝 What if you owe more than the truck’s value

Even with negative equity, professional buyers often work with lenders to handle payoffs and may negotiate arrangements to make the sale feasible. Selling under these conditions is still possible without you getting stuck.

✅ Bottom line: You’re not stuck

Selling a truck while it’s financed is legal, possible, and can be straightforward if you know the steps:

- Get a payoff quote from your lender.

- Compare the payoff to your truck’s market value.

- Accept an offer from a buyer who can handle the payoff and title transfer.

- Receive your cash and walk away free of the loan and vehicle.

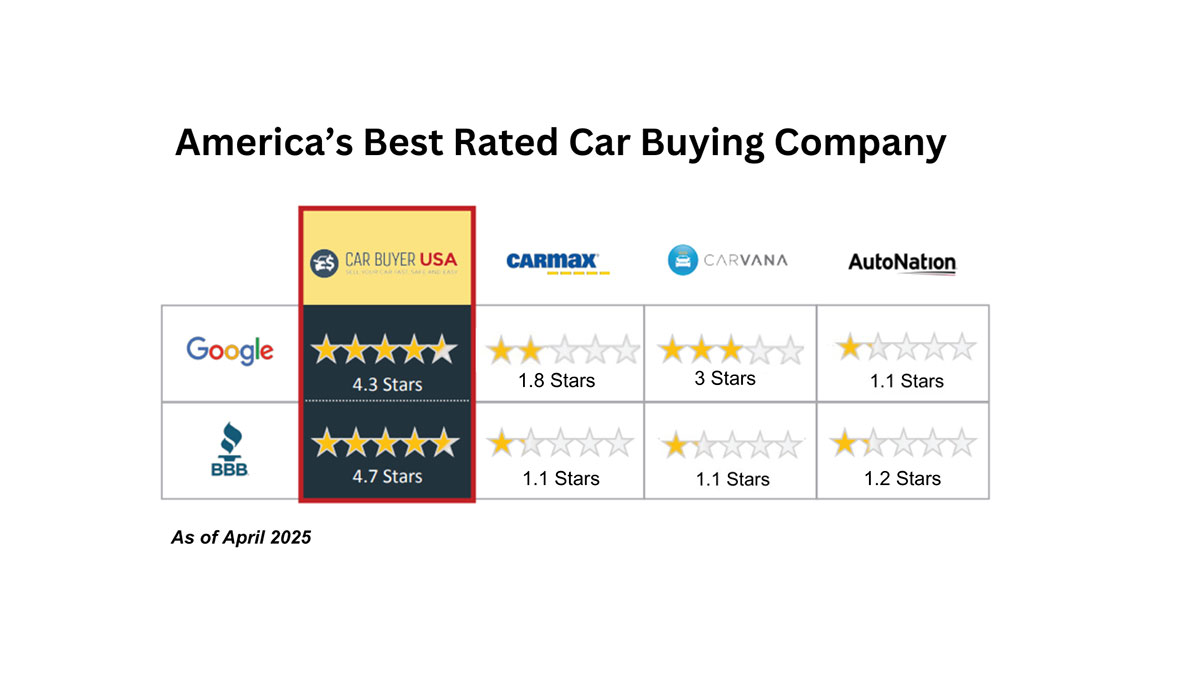

Even if you still owe on your truck, selling it doesn’t have to be complicated. Knowing your payoff amount and understanding your equity makes the process smooth and predictable. The payoff table above shows exactly what you’d walk away with — or what you’d need to pay — before committing to a sale. When you’re ready, CarBuyerUSA.com can handle everything for you: they contact your lender, pay off your loan, complete the title transfer, and deliver your payment. Get top dollar for your truck, avoid the stress of private sales, and walk away free of both the vehicle and the loan. Request your instant quote today and see exactly what you’d receive — it’s fast, easy, and completely hassle-free.