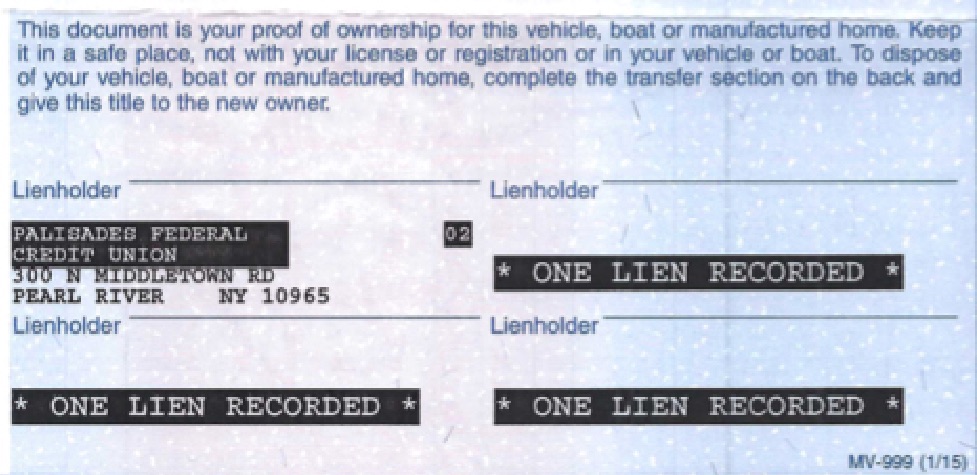

Leased Vehicles and Vehicles being sold with lien payoffs are worth less than a vehicle being sold with “title in hand”. It’s a hard fact and we will explain exactly why this is so.

Let’s take the easier one to explain, first. Vehicles that are financed must be paid off “in full” in order for the finance source (your bank) to release the title for your vehicle to the purchasing party. The payoff balance is always paid to the lending institution so that clear title can be obtained and the ownership interest can be conveyed to the purchaser (CarBuyerUSA/private seller). Selling a vehicle with a lien is more difficult and there are tangible costs associated with a lien payoff purchase.

Here is a list of the most common expenses:

- Interest

- Depreciation

- Fees

- Float

- Tax

- Penalties

FAQ’s

Q: Is my vehicle worth more if I have the title?

A: Technically no it isn’t. A vehicle being sold “title in hand” will be worth the quoted price and liens / leases will be priced adjusted down slightly which is why we ask if the vehicle is leased or financed BEFORE we quote a price to purchase.

Q: Why is there expense for interest?

A: There is a cost of capital factored into any purchase. The larger the purchase, the more significant the impact. Typically, the expense will equate to $2.75 per day for each $10,000 increment. (Example: a $50,000 vehicle will bear an added payoff expense of $13.75 per day).

Q: Is the interest expense calculated off my payoff balance?

A: No. Because the lending institution will not provide the title to your vehicle to CarBuyerUSA until the payoff is made in full, the vehicle cannot be sold and the entire purchase price is considered frozen capital.

Q: How long does the average bank take to release the title to my vehicle once payoff is received?

A: Generally a bank will take up to 30 days. Some take 45 days which will vary based on what bank clearinghouse system they are affiliated with. A small savings and loan or credit union could take longer based upon COVID 19 policies & practices which we have no control over.

Q: What about the price, will the vehicle depreciate?

A: Yes with absolute certainty the price will change dramatically if the title delivery is delayed an inordinate amount of time. Depending on the class of vehicle, we have seen price drops of $1700 in a single week. CarBuyerUSA can only guarantee a price for 72 hours from the date of contract.