What’s Your Reality Now?

Getting hit by an uninsured motorist is one of the worst positions a driver can be in. You didn’t cause the accident. You followed the rules. And now you’re staring at a damaged or totaled car with no responsible party willing or able to pay.

This is where the system quietly shifts the burden onto you.

Why Uninsured Motorist Accidents Spiral Fast

When the other driver has no insurance, there is no safety net. No quick payout. No automatic repairs. Everything becomes conditional.

Here’s what usually happens next:

- The other driver disappears or admits they can’t pay

- Police reports don’t magically produce money

- Lawsuits are expensive and slow

- Your insurance starts looking for ways out

- Your car sits while value drains away

Uninsured motorist accidents aren’t just frustrating — they’re financial traps if you wait too long.

What Your Insurance May (or May Not) Cover

Some drivers have uninsured motorist coverage. Many don’t. Even when coverage exists, it often comes with:

- Coverage limits far below repair costs

- Deductibles you must pay

- Disputes over fault or damage extent

- Delays while adjusters investigate

If you don’t have the right coverage, your insurer may pay nothing at all — leaving you with a wrecked vehicle and zero assistance.

The Hard Truth About Chasing the Other Driver

People love to say, “Just sue them.” Here’s reality:

- Uninsured drivers usually don’t have money

- Court cases take months or years

- Even if you win, collecting is unlikely

- Meanwhile, your car depreciates daily

Winning on paper doesn’t fix your car or pay your bills.

⚠️ The Reality Chart: What Actually Happens After an Uninsured Motorist Accident

Stage |

What You Expect |

What Really Happens |

|---|---|---|

Accident |

Other driver pays |

They’re uninsured |

Police Report |

Helps you recover |

Mostly informational |

Insurance Claim |

Quick solution |

Coverage limits or denial |

Waiting |

Situation improves |

Car loses value |

Repairs |

Affordable fix |

Costs exceed value |

Final Outcome |

Fair resolution |

You absorb the loss |

Time does not work in your favor here.

Why Repairing the Car Yourself Is Risky

Many people consider fixing the car out of pocket. This often backfires.

- Hidden damage appears mid-repair

- Structural or safety issues raise costs

- Accident history permanently lowers resale value

- You rarely recover repair expenses

You end up spending thousands to keep a car that’s still worth less than before the accident.

Why Private Selling Becomes a Nightmare

Private buyers hear “uninsured motorist accident” and immediately assume risk.

Expect:

- Aggressive lowball offers

- Buyers demanding documentation and inspections

- Deals falling apart late

- Weeks or months of wasted effort

Private selling turns into a grind — not a solution.

When the Smart Move Is to Exit the Vehicle

At some point, logic beats emotion. When an uninsured motorist hits you, the smartest move for many owners is to remove the car from the equation entirely.

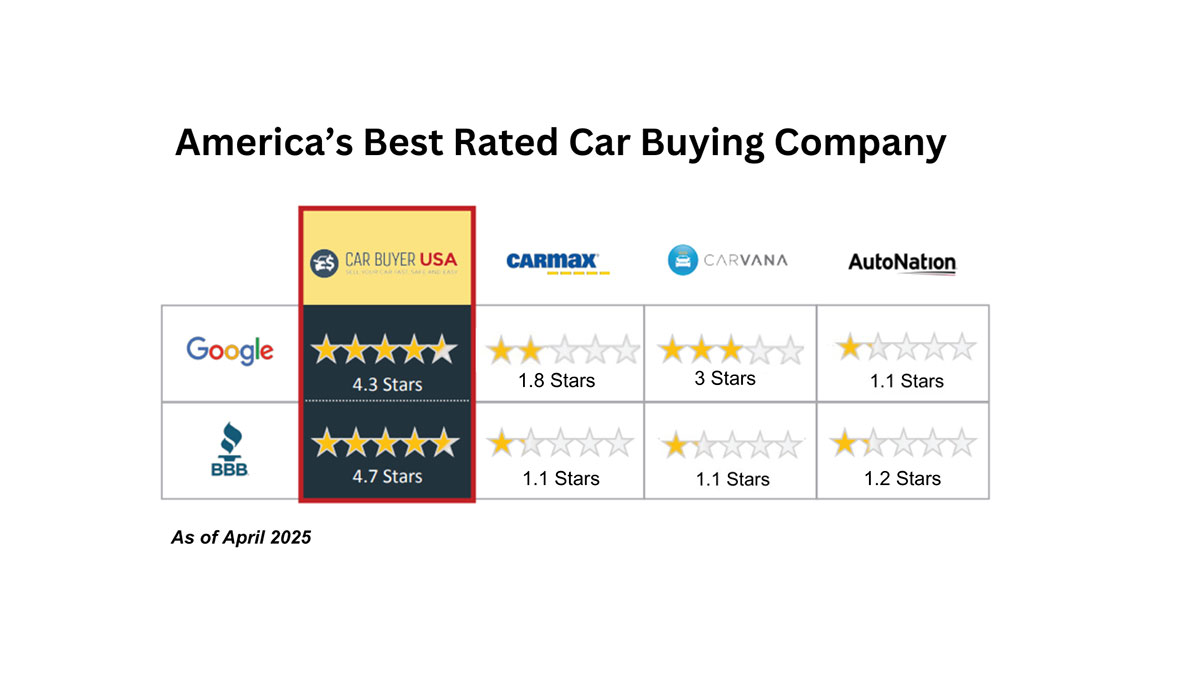

That’s where CarBuyerUSA comes in.

CarBuyerUSA buys accident-damaged vehicles nationwide, including cars hit by uninsured drivers.

No chasing the other driver. No waiting on insurance loopholes. No repairs required.

They evaluate the car as-is, handle pickup, and turn a dead-end situation into immediate cash.

Why CarBuyerUSA Fits This Scenario Perfectly

- Buys vehicles damaged by uninsured motorists

- No insurance payout required

- No repairs needed

- Nationwide

- Fast, real offers

The Final Destination

If you were hit by an uninsured motorist, waiting won’t make the situation better. It makes it more expensive. The car loses value, options shrink, and stress compounds.

Selling the vehicle and moving forward isn’t giving up, it’s cutting off a losing position.

CarBuyerUSA.com gives you a clean exit when the system doesn’t.