Welcome to the Real Game

Your insurance company just denied your accident claim. That moment hits hard. You did everything “right,” paid every premium, reported the accident, waited patiently, and still got shut down. Now you’re staring at a damaged or totaled car and realizing something ugly: insurance works for insurance, not for you.

Let’s break this down fast and brutally honest.

Why Insurance Companies Deny Claims (Even Legit Ones)

Insurance denial is rarely about fairness. It’s about liability avoidance and cost control. Common denial triggers include:

- Fault disputes (even partial fault can kill payouts)

- Lapsed or “technically inactive” coverage

- Claims of pre-existing damage

- Adjusters labeling damage as “uneconomical to repair”

- Uninsured or underinsured other driver

- Policy exclusions buried in fine print

Translation: if there’s a way to reduce or eliminate payout, they’ll find it.

What a Denied Claim Instantly Does to Your Vehicle

The second a claim is denied, your car becomes a financial liability, not an asset.

- Repairs now come out of your pocket

- The car’s resale value drops sharply

- It may not be legally drivable

- Storage, towing, and parking fees stack up

- Dealerships won’t touch it

- Private buyers disappear

And here’s the dirty secret: every day you wait, the car becomes worth less.

⚠️ REALITY CHECK: WHAT HAPPENS NEXT

Option |

Time Required |

Out-of-Pocket

Cost |

Risk

Level

| Likely Outcome |

|---|---|---|---|---|

Fight Insurance

Appeal |

Weeks to

months |

High |

Very High |

Partial payout or denial |

Repair Car Yourself |

Immediate |

Extremely High |

High |

Overpay on a depreciating

asset |

Sell Privately |

Weeks |

Medium |

High |

Lowball offers or no buyers |

Sell Privately |

Weeks |

Medium |

High |

Lowball offers or no buyers |

Sell to

CarBuyerUSA |

Fast |

$0 |

Low |

Immediate cash |

Why “Fighting the Denial” Is Usually a Losing Battle

Appeals sound good on paper. In reality, they are slow, paperwork-heavy, and stacked against you. While you wait, the car sits. While it sits, it depreciates. While it depreciates, you lose leverage.

Even when insurance reverses a decision, payouts often don’t cover full repairs, leaving you with a half-fixed car and sunk costs.

When the Smart Move Is to Exit the Vehicle

At some point, logic beats emotion. If insurance has denied the claim, the smartest move for many owners is to sell the car as-is and move on.

That’s exactly where CarBuyerUSA dominates.

We buy accident-damaged vehicles nationwide...with or without insurance involvement. Denied claim? Doesn’t matter. Unrepaired damage? Not a problem. You don’t fix it. You don’t argue. You don’t wait.

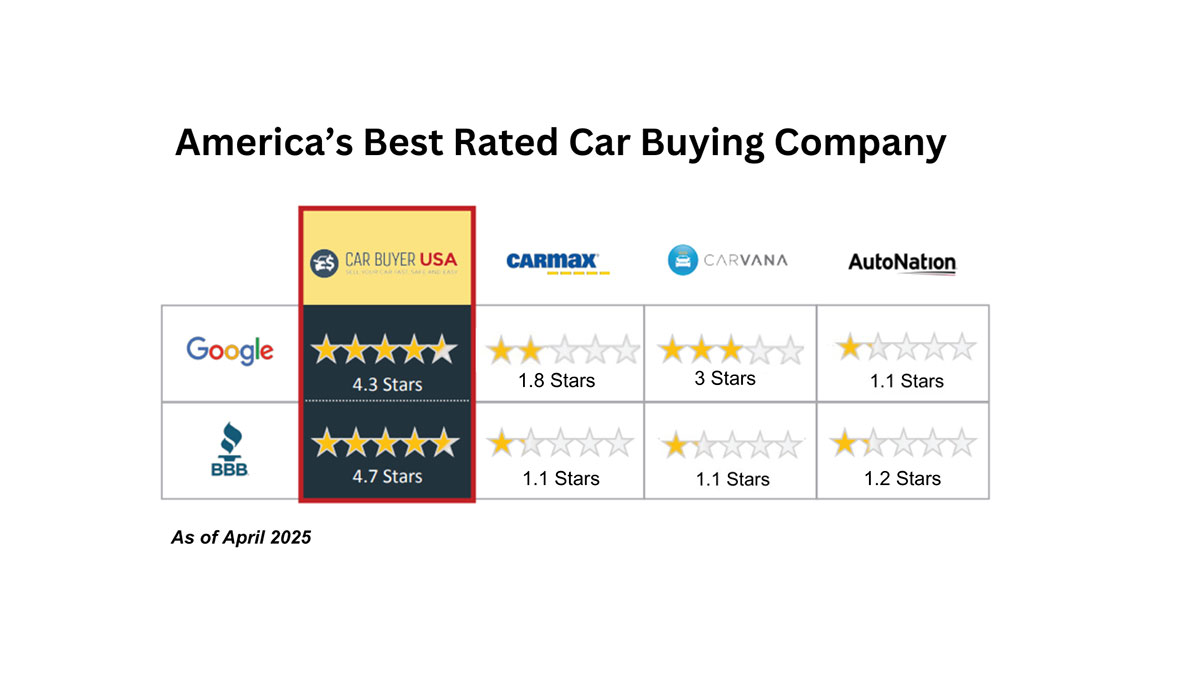

Why CarBuyerUSA Wins When Insurance Loses

- Buys wrecked and accident-damaged vehicles

- No insurance approval required

- No repairs needed

- Nationwide

- Fast, real offers

- Zero games, zero pressure

Final Reality

Insurance denial doesn’t mean you’re trapped, it means the insurance route is closed. CarBuyerUSA.com is the exit.

When insurance refuses to step up, you don’t fight a rigged system. You cash out and move forward.