For years, NADA was widely recognized and respected estimate of your car’s worth, especially among dealerships, banks, and insurance companies. However, its usefulness depends on your specific situation and expectations. It was acquired by JD Power and they ultimately shut down the NADA Consumer site and everything has changed – not for the better!

What you need to know:

NADA (National Automobile Dealers Association) values are commonly used by car dealerships, banks, and insurance companies to determine trade-in, retail, and loan values for vehicles. If you’re trading in your car or seeking a loan, the NADA value is likely what these institutions will reference.

NADA values are built from actual transaction data collected from franchise dealerships, making them reliable for institutional purposes like loans and insurance settlements. This data-driven approach is one reason NADA values are trusted in the industry.

Banks and insurance companies often use NADA values to determine how much they’ll lend on a car or pay out in the event of a claim. This makes NADA a critical benchmark in financial and insurance decisions.

Limitations of NADA Values:

NADA values generally assume the car is in “well-maintained”, above-average condition. If your car has significant wear or damage, the actual market value will be lower than the NADA estimate.

NADA does not provide private party values. If you’re selling your car directly to another individual, JD Power has taken over for the consumer-direct valuation site and is no longer offering Used Car Values to consumers for free. In Fact, JD Power has a site that is so convoluted and crowded with advertisers that it’s impossible to even find a used car value. They will, however, sell your vehicle & personal information to their dealer subscribers that will enter you into their call center data base and spam you at no additional cost! But hey it’s free, right?

- Because NADA values are based on dealer retail transactions and often assume excellent condition, they can sometimes be higher than what you’d actually get from a dealer or private buyer, especially if your car has issues.

- Dealers often use NADA as a starting point but may offer less based on auction prices, needed repairs, or their own profit margins.

How to Use NADA Values Effectively:

- As a Benchmark:

Use the NADA value as a reference point but also check other guides like Kelley Blue Book and Edmunds, and get quotes from local dealers to understand the full range of your car’s worth.

- Prepare for Negotiation:

Selling your vehicle is a lot of work and you should expect the dealer to start negotiations below the NADA value, especially if your car needs work. Private Buyers are not kinder or more generous than local dealers. They low ball unsuspecting sellers and waste your time which makes the process of selling your car yourself more tedious and troublesome.

- For Loans and Insurance:

If you’re financing or insuring your car, know that the NADA value will likely be the number used by your lender or insurer.

Bottom Line:

An NADA value – if you can get one, is a good, industry-accepted estimate—especially for trade-ins, loans, and insurance—but it may not reflect the “exact” amount you’ll receive in a private sale or from a dealer, particularly if your car isn’t in top condition. Use it as one tool among several to get the most accurate picture of your car’s value.

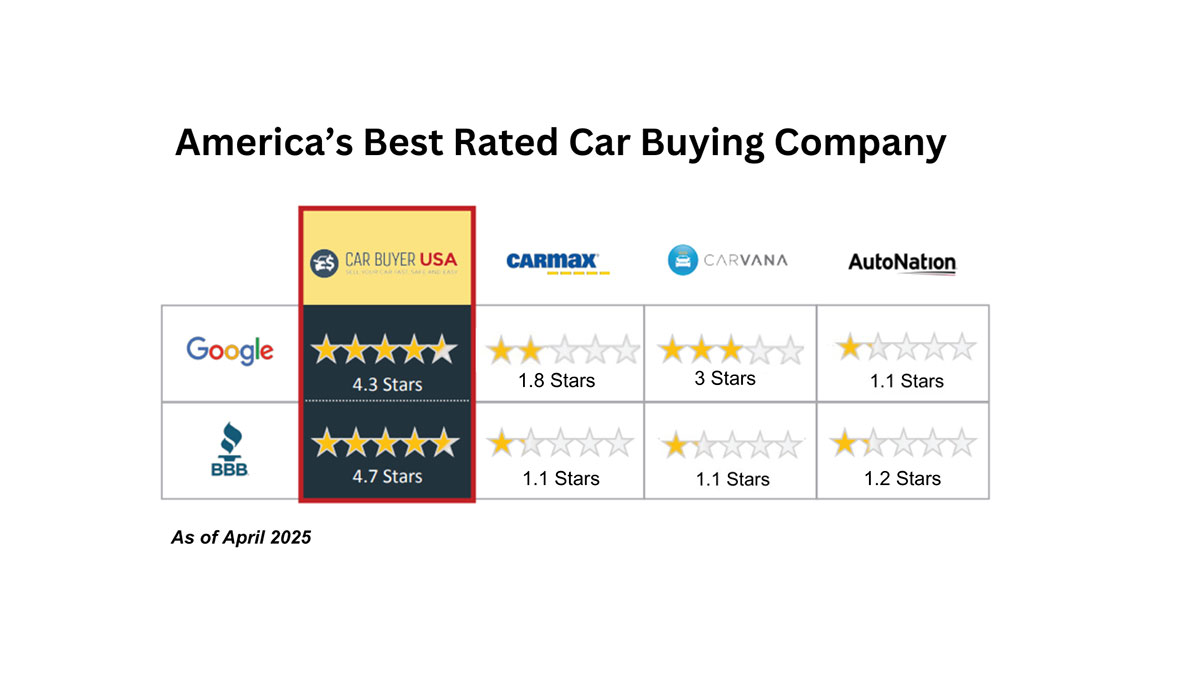

The best value you can get for your car is a CASH OFFER that you can use to make an educated decision on whether to trade it in or sell it privately. For an instant cash offer on your car, truck or SUV visit CarBuyerUSA.com. You get an offer onscreen in under 20 seconds and you don’t have to give up your phone # and email address to get it!