The Responsible Move Nobody Wants to Admit

Financial emergencies don’t announce themselves politely. They don’t wait until it’s convenient. One minute things are “tight but manageable,” and the next you’re staring at overdue bills, a drained account, or a situation that needs cash now, not next month.

This is the moment where people either make a smart move... or a desperate one.

Let’s clear something up right away: needing to sell a vehicle because of a financial emergency is not failure. It’s not irresponsible. What is irresponsible is pretending the problem will fix itself while interest, penalties, and stress quietly pile up in the background.

When money is tight, people are often pushed toward the worst possible solutions—payday loans, credit card cash advances, or “temporary” debt that somehow becomes permanent. Those options don’t solve emergencies. They monetize them. They trade today’s relief for tomorrow’s regret.

The responsible move isn’t borrowing more money you don’t have.

It’s creating liquidity.

Cars are not sacred objects. They’re depreciating assets that cost money every single month, insurance, registration, maintenance, fuel, and sometimes payments. Holding onto a vehicle you can’t afford during a financial emergency doesn’t make you disciplined. It makes you trapped.

When you need money right now, the most dangerous move isn’t selling—it’s choosing fast cash that quietly chains you to future payments. Liquidity fixes problems. Debt multiplies them. And once you actually lay the options out side by side, the difference becomes painfully obvious.

📊 Emergency Cash Options: What Actually Makes Sense?

Option |

Speed |

Hidden Cost |

Stress Level |

Long-Term Damage |

|---|---|---|---|---|

Payday Loan |

Fast |

Extremely High

Interest |

🔥🔥🔥 |

Severe |

Credit Card Cash Advance |

Fast |

High Fees + APR |

🔥🔥 |

High |

Borrowing From

Friends/Family |

Medium |

Emotional Cost |

🔥🔥🔥 |

Medium |

Dealer Trade-In |

Slow |

Lowball Offer |

🔥 |

Medium |

Selling to CarBuyerUSA |

Fast |

None |

🔥 |

Low |

This is why selling a vehicle during a financial emergency isn’t panic, it’s clarity. One option adds weight. The other removes it. Turning a depreciating asset into cash without creating new debt is how people stop the bleeding instead of pretending it isn’t happening.

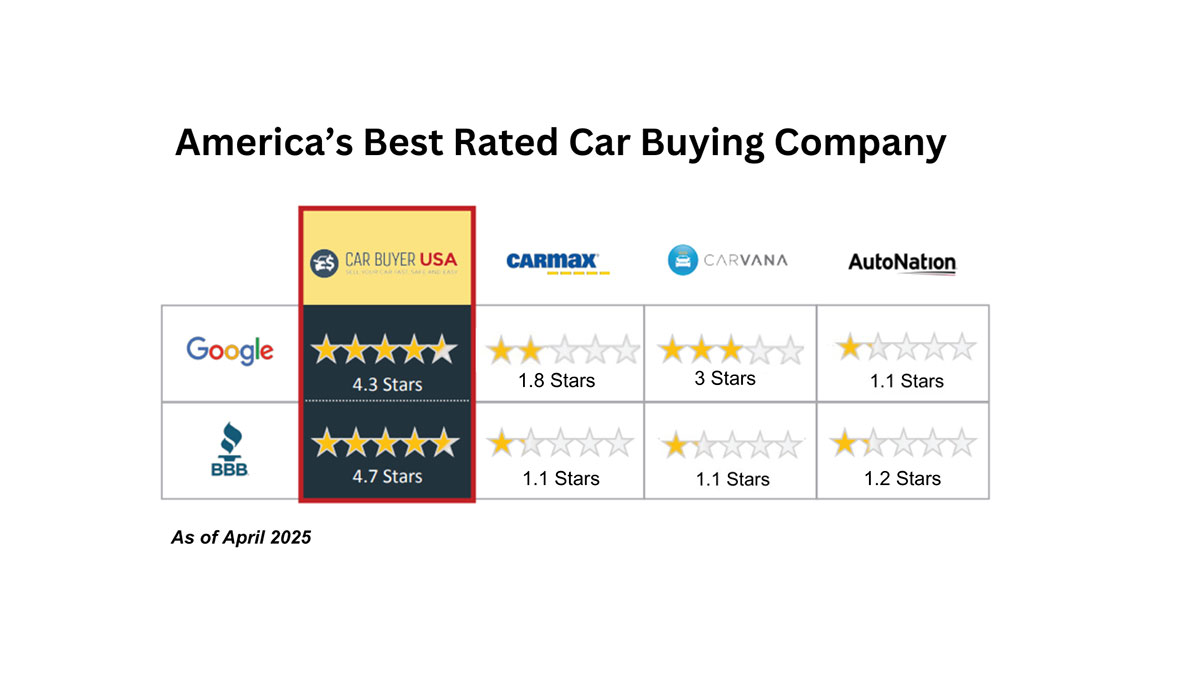

CarBuyerUSA exists for this exact moment. When sellers are ready to be honest about their situation. When they don’t want lectures, delays, or lowball games. When they need real liquidity. not another bill disguised as help.

There’s no judgment here. Financial emergencies happen to responsible people every single day. Medical issues. Job disruptions. Family obligations. Unexpected expenses. What matters isn’t that it happened—it’s how you respond.

The savage truth?

Most people don’t lose control because of one emergency. They lose control because they refuse to make the uncomfortable move that fixes it.

If you need the money. If taking on more debt would bury you. If selling your vehicle gives you breathing room and a reset! That’s not giving up. That’s taking control.

CarBuyerUSA.com gives sellers a clean exit when life gets messy. No new debt. No shame. Just liquidity, clarity, and a chance to move forward on your terms.

And sometimes, that’s the most responsible decision you can make. Call NOW!