25 Million vehicles are wrecked each year in the USA, that’s 68,500 per day! While most of the accidents are minor to moderate, 40% of them result in a total loss. The total losses are easily justified because the insurance carrier determines the retail value and writes you a check for that amount. The trigger for the total loss is the proportion of damage in relation to the retail value. In most states, the threshold runs from 50-100%.

If your accident doesn’t result in a total loss, you are saddled with the chore of finding a new way to get to work while your car gets fixed. Yes, you belong to the 60% group and your car will be “pieced-back” together at a collision repair facility. This is quite an adventure because you want the best possible repair quality, but you probably don’t want to pay your insurance deductible. Guess what? Those two things are polar-opposites and if your primary driver is “saving your deductible”, you are going to get poor quality repair work and the car will have terrible resale value. It’s also insurance fraud to even suggest to the collision repair center to “bury” the deductible by overcharging the insurance company for the repairs. So, let’s take a quick look at the expense breakdown:

Vehicle Market Value: $25,000

Collision Repair Estimate: $8,500 (34% of retail value so does not qualify for total loss)

Deductible: $1,500 (Cash out of pocket)

Diminished Value: $3,000 ( 12% Stigma loss due to wreck)

Equity position in vehicle: $20,500

You will notice that we added a fourth item for Diminished Value which is the loss in value you realize after the accident, which will hit CarFax & AutoCheck Vehicle History Reports.

If you consider the above example with a very modest Diminished Value Loss Estimate, your equity position in this vehicle just declined by $4,500 if the collision repair work was performed impeccably. If there is evidence of structural damage, the Diminished Value will double. Structural Damage on a CarFax crushes the resale value of any vehicle. The only way around this loss is to export the car where vehicle history reports have no impact on value.

We present you a much better option! Sell the damaged vehicle “as-is”, pocket the repair check and evade the Diminished Value Loss & Structural Damage Stigma. There is a very robust damaged vehicle marketplace that most consumers do not know about. Damaged Vehicle Buyers (rebuilders) frequent Salvage Auctions to purchase wrecked cars & trucks to restore and resell at below market value prices. These vehicles are either exported or sold to the public here in the USA, generally to people with below average credit. It’s difficult to gain access to this marketplace as it is B2B only and highly regulated. By selling your damaged vehicle to CarBuyerUSA.com, we provide competitive offers on damaged vehicles and feed into this closed marketplace on your behalf. Consider the following scenario on the same vehicle:

Vehicle Market Value $25,000

Collision Repair Estimate $8,500 (You keep this check from the insurance company)

Deductible $1,500 (You keep this also)

Diminished Value $3,000 ( You save this inherent loss)

Vehicle sold as-is $14,000 (CarBuyerUSA send you a check)

Equity position after sale $27,000

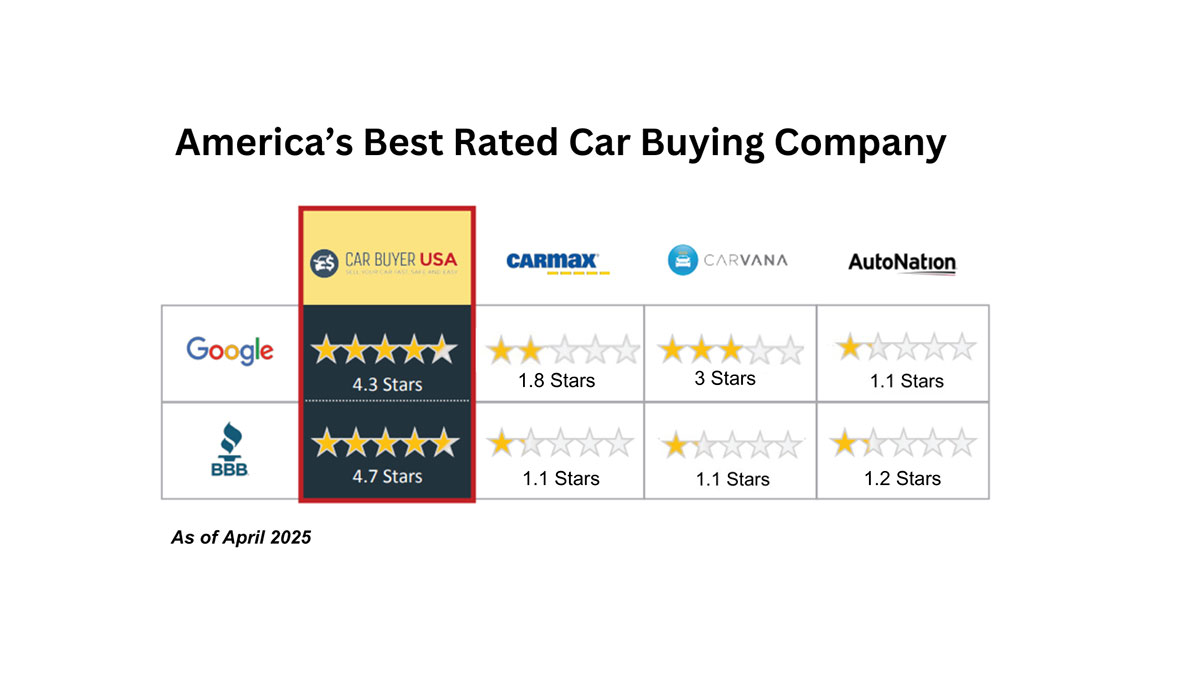

You may be skeptical, but the good news is that it will cost you nothing to find out what the damaged vehicle can be sold for! Visit CarBuyerUSA.com and get an offer on any vehicle, in any condition, anywhere in the continental US absolutely free – 24/7/365. You don’t have to provide any contact data, your offer is on-screen and immediate. If you like it, OPT-IN and we will contact you immediately to complete the sale. We have a 4.3 Star Rating on Google and 4.7 on BBB. CarBuyerUSA has been operating for 13 years and is the highest rated Car Buying Company in the USA.