Louisiana State Title Processing Procedures

- What form of title must an insurer obtain in connection with the sale of a vehicle that has been acquired through the settlement of a claim?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title (aka “Clean Title”)?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title branded “Hail-Damaged Vehicle”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title branded “Water-Damaged Vehicle”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Salvage Certificate of Title (aka “Salvage Title”)?

- What documents must an insurer provide to CarBuyerUSA in order to sell a recovered theft vehicle recovered substantially intact with no substantial damage, where title is still in the name of the insured?

- What steps must an insurer take in Louisiana to process an ownerretained vehicle?

- hat legal duties are imposed upon a lienholder following satisfaction of the lien?

- What form of title must an insurer obtain in connection with the sale of

a vehicle that has been acquired through the settlement of a claim?

Laws pertaining to titling of total loss vehicles can be found at in the Louisiana Revised Statutes, Title 32, Chapter 4, excerpts of which are set forth below:

§ 702. Definitions

-

(10) The term "salvage title" shall mean a certificate used to evidence the

declaration in an insurance settlement that a motor vehicle is a "total loss"

motor vehicle as provided in this Chapter, to be prescribed and distributed

by the office of motor vehicles, to an insurance company, its authorized

agent, or the owner of a "total loss" motor vehicle.

(11) The term "total loss" means a motor vehicle which has sustained damages equivalent to seventy-five percent or more of the market value as determined by the most current National Automobile Dealers Association Handbook. However, a motor vehicle that sustains cosmetic damages caused by hail equivalent to seventy-five percent or more of its market value as a result of costs for repairs to items such as windshields, windows, and rear glass, exterior paint and paint materials, and body damage such as dents shall not be deemed a “total loss” and salvaged; however, such vehicles shall be issued a branded title indicating the vehicle has sustained hail damage.

-

I. (1)(a) When, as the result of an insurance settlement, a motor vehicle is

declared to be a "total loss", as defined in R.S. 32:702(11), the insurance

company, its authorized agent, or the vehicle owner shall, within thirty days

from the settlement of the property damages claim, send the certificate of

title to the office of motor vehicles along with an application for a salvage

title in the name of the insurance company, or its authorized agent, or the

vehicle owner.

(b) Upon receipt of the salvage title, the insurance company, its authorized agent, or the vehicle owner may proceed to dismantle the vehicle, sell it, or rebuild and restore it to operation. A rebuilder of a salvaged title motor vehicle may upon completion of rebuilding the vehicle demonstrate the rebuilt motor vehicle to a prospective purchaser without applying for a reconstructed vehicle title. Except for the purposes of this demonstration, no rebuilt and restored vehicle shall be operated upon any public street roadway, or highway until it is registered with the office of motor vehicles, and a reconstructed vehicle title is issued.

§ 1261 Water Damage from Flooding:

-

No used motor vehicle dealer, nor any person or entity, shall, sell, transfer,

or convey any used motor vehicle to any person without notifying the buyer

or receiver of the vehicle in writing of the extent of any water damage from

flooding which occurred to the vehicle prior to the transaction.

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Title (aka “Clean Title”)?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a notarized power of attorney), an odometer disclosure statement, a release of any liens, bill of sale, a cost of repair, and an ACV.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title to the purchaser. back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Title branded “Hail-Damaged Vehicle”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a notarized power of attorney), an odometer disclosure statement, a release of any liens, hail damage statement, and bill of sale. CarBuyerUSA will submit these documents along with a Vehicle Application for Salvage Certificate of Title, hail damage statement, and the appropriate fee to the Office of Motor Vehicles for processing.

Thereafter, the Office of Motor Vehicles shall issue a Certificate of Title branded “Hail-Damaged Vehicle” in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title branded “Hail-Damaged Vehicle” to the purchaser.

[Louisiana Revised Statutes, Title 32, § 702(11)] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Title branded “Water-Damaged Vehicle”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a notarized power of attorney), an odometer disclosure statement, a release of any liens, water damage statement, and bill of sale.

CarBuyerUSA will submit these documents along with a Vehicle Application for Salvage Certificate of Title, water damage statement, and the appropriate fee to the Office of Motor Vehicles for processing.

Thereafter, the Office of Motor Vehicles shall issue a Certificate of Title branded “Water-Damaged Vehicle” in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title branded “Water-Damaged Vehicle” to the purchaser.

[Louisiana Revised Statutes, Title 32, § 1261] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Salvage Certificate of Title (aka “Salvage Title”)?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a notarized power of attorney), an odometer disclosure statement, a release of any liens, and bill of sale.

CarBuyerUSA will submit these documents along with a Vehicle Application for Salvage Certificate of Title and the appropriate fee to the Office of Motor Vehicles for processing.

Thereafter, the Office of Motor Vehicles shall issue a Salvage Certificate of Title in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Salvage Certificate of Title to the purchaser. [Louisiana Revised Statutes, Title 32, § 707(I); Louisiana Administrative Code, 55, Part III, Chapter 13, §§ 1335, 1339] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

recovered theft vehicle recovered substantially intact with no

substantial damage, where title is still in the name of the insured?

When a vehicle has been stolen, the insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a notarized power of attorney), an odometer disclosure statement and a release of any liens. After receiving these documents, CarBuyerUSA will fill out a Vehicle Application for Certificate of Title and check the stolen vehicle box. This form along with the above documents and the appropriate fee will be forwarded to the Office of Motor Vehicles for processing.

Thereafter, the Department of Motor Vehicle will issue a Certificate of Title in the name of the insurer and return it to CarBuyerUSA. Upon receipt, CarBuyerUSA will forward the Certificate of Title to the insurer for safekeeping.

If the vehicle is recovered, the Certificate of Title along with an ACV and a cost of repair will be returned to CarBuyerUSA by the insurer in order to obtain the appropriate title depending upon the year of the vehicle and the damage to the vehicle.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title to the purchaser.

[Louisiana Administrative Code, 55, Part III, Chapter 13, §§ 1333, 1335] back to top

- What steps must an insurer take in Louisiana to process an

owner-retained vehicle?

Pursuant to Louisiana OMV Policy and Procedure, Section IV Motor Vehicle Registration Requirements, Number 42.04:

When an insurance company has declared a vehicle to be a total loss (damage equivalent to 75% or more of the loan value as determined by the current NADA book), and the owner elects to retain the salvage, the owner does not have to sign the title to the insurance company since the vehicle is not being transferred as a total loss.

The owner has the option to apply for a salvage title in his name and pay applicable fees or apply for a permit to dismantle, which is issued at no charge. No sales tax will be due on a salvage retention as long as the owner does not assign the title to the insurance company.

If the owner applies for a salvage title, the DPSMV 1799 application form must be completed in his/her name and accompanied by his/her original title, a copy of the salvage retention document issued by the insurance company or proof of loss, and applicable fees.

If the owner applies for a permit to dismantle, a DPSMV 1633 application form for permit to dismantle must be completed in the titled owner's name and submitted along with his/her original title. Permits to dismantle are issued free of charge by the Dealer Support Unit, Headquarters.

If the owner fails to obtain a salvage title or permit to dismantle prior to the vehicle being rebuilt, the application can be processed as a double transfer (salvaged vehicle/reconstructed vehicle). A DPSMV 1799 application form must be completed for a salvage title in the titled owner's name and placed with the reconstructed vehicle file. A copy of the salvage retention document or proof of loss, as well as all applicable fees, must accompany the application for salvage title.

If the owner assigns the title to the insurance company for the total loss vehicle, the insurance company must apply for a salvage title in its name. The insurance company must then assign the salvage title back to the owner and furnish him/her with a notarized bill of sale and a disclosure of salvage vehicle form. When the vehicle has been rebuilt, the owner will re-title it as a reconstructed vehicle and pay all applicable fees and sales tax. back to top

- What legal duties are imposed upon a lienholder following satisfaction

of the lien?

Pursuant to Louisiana Revised Statutes, Title 32 § 708(B):

-

B. (1) Upon the final discharge of any chattel mortgage or security interest,

the owner or any lien holder may present the certificate of title with the fee

prescribed by law, if not prepaid, to the commissioner and request that the

commissioner note on the face of the certificate of title and his records a

cancellation of notation of said lien so endorsed as satisfied by the holder thereof on the face of the certificate of title. The commissioner shall comply

with such request, if the satisfaction appears genuine.

(2) When the certificate of title endorsed to evidence satisfaction of a lien noted thereon has been lost or stolen, the commissioner may issue a duplicate certificate of title noted on its face to show cancellation of notice of lien so endorsed, only when all the following conditions have been satisfied:

(a) The owner establishes to the satisfaction of the commissioner on a form satisfactory to him, that he is unable to obtain a duplicate certificate of title endorsed by the lien holder as provided in Paragraph (1) of this Subsection, due to the fact that the lien holder is no longer in existence.

(b) The secured party of record has filed a termination statement as provided by R.S. 10:9-513.

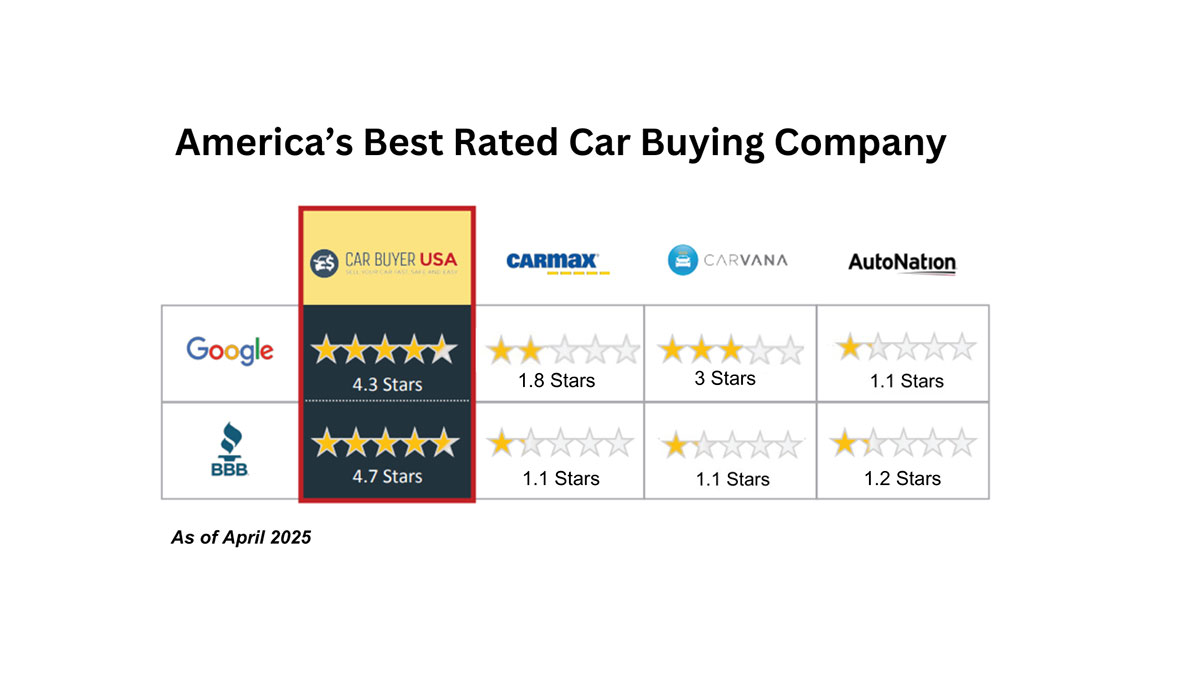

CarBuyerUSA's Ratings VS The Big Guys

How It Works

We pay cash for cars, trucks, & SUVs, in any condition, anywhere in the Continental USA.

1

Get an Instant Cash Offer

Enter the Year, Make, Model, Trim Level & Miles (No VIN Required) and your cash offer appears onscreen (94% of the time)

2 Accept your offer

CarBuyerUSA offers are Cash Market Value.

Funds are guaranteed and paid at the time of pickup or drop-off

3Talk to an Agent

Your CarBuyerUSA representative schedules a no obligation inspection. In most markets an on-site mobile inspection can be arranged. The digital purchase agreement takes less than 60 seconds to complete.

4 Get Paid

When CarBuyerUSA picks up your truck, you are paid on the spot in full with guaranteed funds – entire process is hassle free.

Inspection, title work & pick up are all FREE.