South Carolina State Title Processing Procedures

- What form of title must an insurer obtain in connection with the sale of a vehicle that has been acquired through the settlement of a claim?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title branded “Salvage”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle as Non-Rebuildable on a Bill of Sale?

- What documents must an insurer provide to CarBuyerUSA in order to sell a recovered theft vehicle recovered substantially intact with no substantial damage, where title is still in the name of the insured?

- What steps must an insurer take in South Carolina to process an ownerretained vehicle?

- What legal duties are imposed upon a lienholder following satisfaction of the lien?

- What form of title must an insurer obtain in connection with the sale of

a vehicle that has been acquired through the settlement of a claim?

Pursuant to the Code of Laws of South Carolina § 56-19-480:

-

(B) If a vehicle is acquired by an insurance company in settlement

of a claim to the vehicle by fire, flood, collision, or other causes, or

is left with the claimant after being declared a total loss by the

insurance company, the company or its agent immediately shall

deliver to the department the certificate of title together with a report

indicating the type and severity of damage to the vehicle. At such

time as the insurance company may thereafter transfer the damaged

vehicle, the company or its agent shall notify the department to

whom the transfer was made on a form prescribed by the

department. Notwithstanding another provision of law, when an

insurance company obtains title to a vehicle from settling a total loss

claim, the insurance company may obtain a title to the vehicle

designated as "salvage". The insurance company must pay the title

fee contained in Section 56-19-420.

(G) For purposes of this section, a "wrecked vehicle", a "salvage vehicle", and a "vehicle declared to be a total loss" are all synonyms and are defined to be any motor vehicle which is damaged to the extent that the cost of repairing the motor vehicle, including both parts and reasonable market charges for labor, equal or exceed seventy-five percent of the fair market value of the motor vehicle.

The provisions contained in this section do not apply to a motor vehicle that has a fair market value of two thousand dollars or less, or an antique motor vehicle as defined by Section 56-3-2210. When an insurance company is involved, the fair market value of the vehicle must be determined as of the date immediately before the event which gave rise to the claim. When an insurance company is not involved, then the fair market value must be determined as of the last day on which the vehicle was lawfully operated on a public highway or the last day on which it was registered, whichever is later.

-

Notwithstanding any other provision of law, whenever any motor

vehicle which qualifies as "wreckage" or "salvage" is transferred in

this State pursuant to Section 56-19-480, whether the vehicle was,

immediately before such transfer, titled in this State or in another

state, the vehicle shall be designated as "wreckage" or "salvage", as

may be applicable, to the extent necessary to inform the transferee of

the exact condition of the vehicle. No wrecked or salvaged out-ofstate vehicle or South Carolina registered vehicle shall be registered

under the laws of this State without such designation, and this

designation must be applied to all subsequent transfers of the

vehicle.

The provisions of this section apply to transfers of vehicles in all of the circumstances described in Section 56-19-480, whether the vehicle is "totaled", declared a total loss, "junked", or "salvaged". Notwithstanding the provisions of this section, the owner of a vehicle whose total cost of repair, including all labor and parts, is estimated to be seventy-five percent or more of the fair market value of the vehicle must provide the department an affidavit from a person who reconstructs or rebuilds a vehicle indicating the cost of repair along with other data the department may prescribe to obtain a certificate of title. The provisions contained in this section do not apply to a motor vehicle that has a fair market value of two thousand dollars or less, or an antique motor vehicle as defined by Section 56- 3-2210. A certificate of title issued for a vehicle described in this paragraph must be annotated to indicate the motor vehicle is designated "wreckage" or "salvage" as applicable to the extent necessary to inform the transferee of the exact condition of the vehicle. A wrecked or salvaged out-of- state vehicle or South Carolina registered vehicle may not be registered in this State without this designation, and this designation must be applied to subsequent transfer of the vehicle. back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Title?

he insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair. CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title to the purchaser. back to top - What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Title branded “Salvage”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair. CarBuyerUSA will submit these documents along with an Application for Certificate of Title/Registration (Form 400) and the appropriate fee to the Division of Motor Vehicles for processing.

Thereafter, the Division of Motor Vehicles shall issue a Certificate of Title branded “Salvage”, “Salvage - Fire”, or “Salvage - Water”, as appropriate, in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title branded “Salvage”, “Salvage - Fire”, or “Salvage - Water”, as appropriate, to the purchaser. [See Code of Laws of South Carolina §§ 56-19-480, 56-19-485; PCA Driver and Vehicle Policy Manual, Policy No. 97-501] back to top - What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle as Non-Rebuildable on a Bill of Sale?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with an Application for Certificate of Title/Registration (Form 400) and the appropriate fee to the Division of Motor Vehicles for processing.

Thereafter, the Division of Motor Vehicles shall issue a certificate of title branded non-rebuildable in the name of the insurer CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction on a certificate of title branded non-rebuildable. [See Code of Laws of South Carolina § 56-19-480] back to top - What documents must an insurer provide to CarBuyerUSA in order to sell a

recovered theft vehicle recovered substantially intact with no

substantial damage, where title is still in the name of the insured?

When a vehicle has been stolen, the insurer shall provide CarBuyerUSA with a Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement with last known mileage, and a release of any liens.

After receipt of these documents, CarBuyerUSA will submit these documents along with an Application for Certificate of Title/Registration (Form 400) and the appropriate fee to the Division of Motor Vehicles for processing.

Thereafter, the Division of Motor Vehicles shall issue Certificate of Title branded “Warning Odometer Discrepancy” (since no one can verify mileage). Upon receipt, CarBuyerUSA will forward this title to the insurer for safekeeping.

If the vehicle is recovered, the title along with an ACV and a cost of repair will be returned to CarBuyerUSA by the insurer in order to obtain the appropriate title depending upon the year of the vehicle and the damage to the vehicle. CarBuyerUSA, acting upon a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s appropriate title to the purchaser. [See Code of Laws of South Carolina § 56-19-280] back to top - What steps must an insurer take in South Carolina to process an

owner-retained vehicle?

Pursuant to Code of Laws of South Carolina § 56-19-480(B):

If a vehicle is acquired by an insurance company in settlement of a claim to the vehicle by fire, flood, collision, or other causes, or is left with the claimant after being declared a total loss by the insurance company, the company or its agent immediately shall deliver to the department the certificate of title together with a report indicating the type and severity of damage to the vehicle. At such time as the insurance company may thereafter transfer the damaged vehicle, the company or its agent shall notify the department to whom the transfer was made on a form prescribed by the department. Notwithstanding another provision of law, when an insurance company obtains title to a vehicle from settling a total loss claim, the insurance company may obtain a title to the vehicle designated as "salvage". The insurance company must pay the title fee contained in Section 56-19-420. back to top

- What legal duties are imposed upon a lienholder following satisfaction

of the lien?

Pursuant to Code of Laws of South Carolina § 56-19-680:

- Upon the satisfaction of a security interest in a vehicle for which the certificate of title is in the possession of the lienholder, he shall, within ten days after demand and, in any event, within thirty days, execute a release of his security interest, in the space provided therefor on the certificate or as the Department prescribes, and mail or deliver the certificate and release to the Department which shall file the release and note it upon the record of security interest maintained by the Department pursuant to § 56-19-660. The Department shall then mail the certificate to the next lienholder or if no other lienholder, then to the owner. No charge shall be made by the lienholder for executing such release.

- Upon the satisfaction of a security interest in a vehicle for which the certificate of title is in the possession of a prior lienholder, the lienholder whose security interest is satisfied shall within ten days after demand, and, in any event, within thirty days execute a release in duplicate in the form the Department prescribes and deliver or mail a copy to the owner and a copy to the Department for notation upon the record of security interests maintained by the Department pursuant to § 56-19-660.

- Upon failure of the lienholder to forward the certificate to the

Department as required by this article he shall be guilty of a misdemeanor

and upon conviction thereof, shall be fined not more than one hundred

dollars or be imprisoned for not more than thirty days. back to top

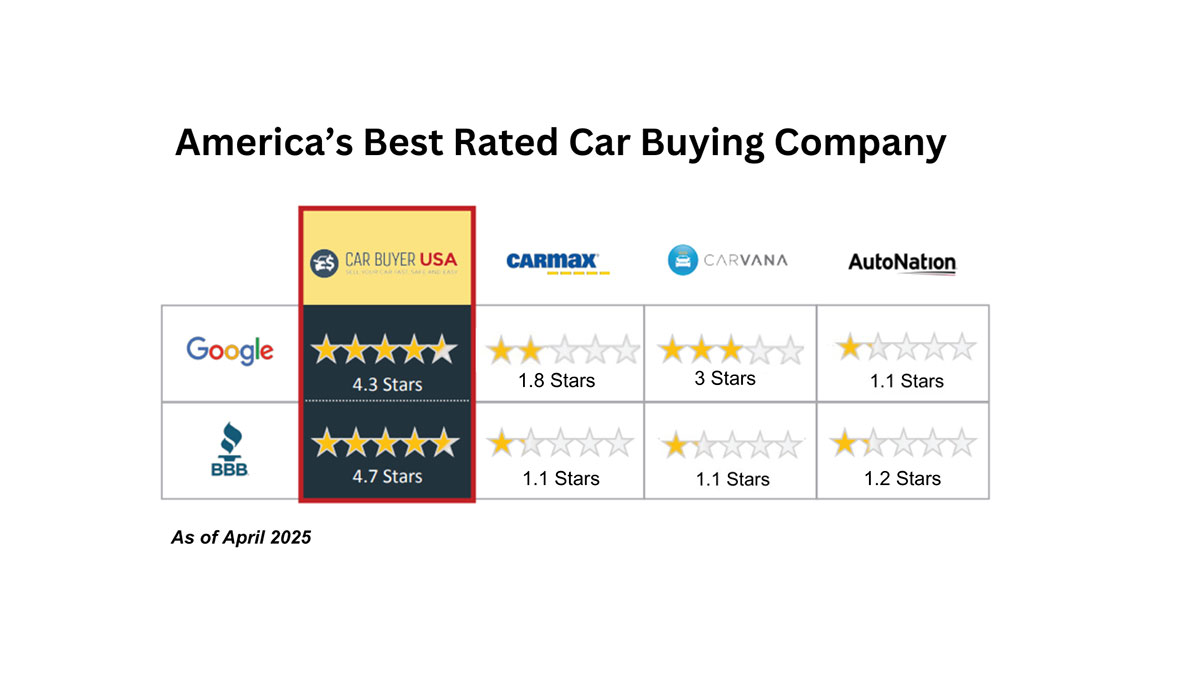

CarBuyerUSA's Ratings VS The Big Guys

How It Works

We pay cash for cars, trucks, & SUVs, in any condition, anywhere in the Continental USA.

1

Get an Instant Cash Offer

Enter the Year, Make, Model, Trim Level & Miles (No VIN Required) and your cash offer appears onscreen (94% of the time)

2 Accept your offer

CarBuyerUSA offers are Cash Market Value.

Funds are guaranteed and paid at the time of pickup or drop-off

3Talk to an Agent

Your CarBuyerUSA representative schedules a no obligation inspection. In most markets an on-site mobile inspection can be arranged. The digital purchase agreement takes less than 60 seconds to complete.

4 Get Paid

When CarBuyerUSA picks up your truck, you are paid on the spot in full with guaranteed funds – entire process is hassle free.

Inspection, title work & pick up are all FREE.